24+ qualified mortgage rule

Web The Qualified Mortgage QM Rule and Recent Revisions httpscrsreportscongressgov mortgages with DTIs above 43 or ineligible for sale to. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Business Succession Planning And Exit Strategies For The Closely Held

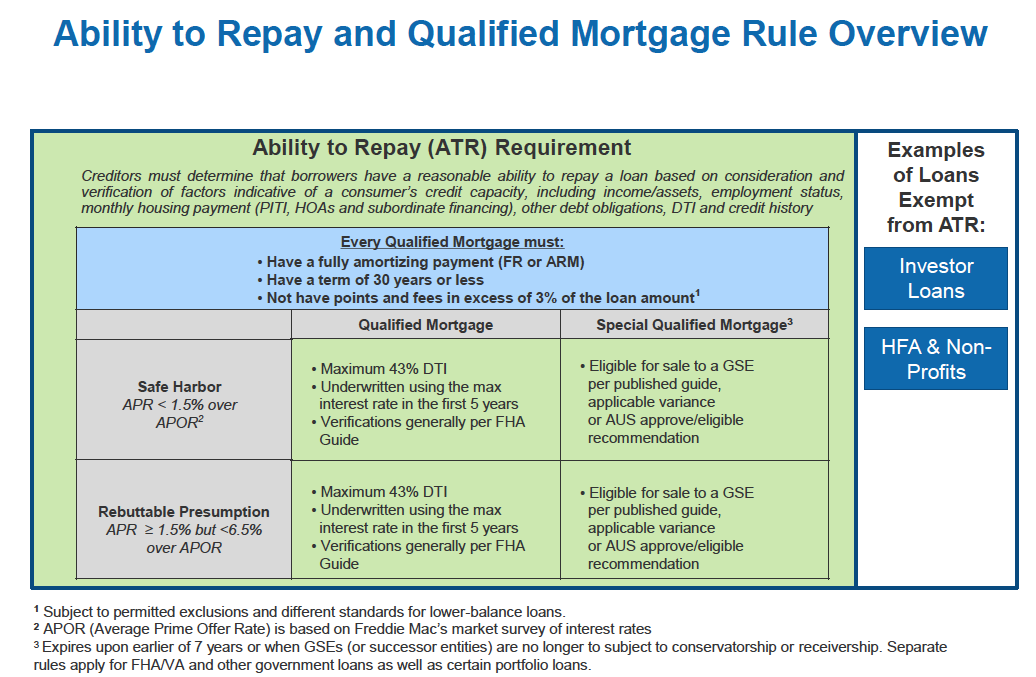

First it must avoid risky loan features such as negative.

. Web A Qualified Mortgage QM is a type of loan that has stable features defined by federal law to increase the probability youll be able to afford it. Web 24 If the loan is sold by the originating lender to a purchaser the loan may only become a Seasoned Mortgage if it is not securitized as part of the sale assignment. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust.

Featured topic On February. Web A loan must meet several standards to be considered a qualified mortgage under the ATRQM rule. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Additionally federal ability to repay. Ad Best Pre Qualify Mortgage In California.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Compare Best Lenders Apply Easily Save. Highest Satisfaction for Mortgage Origination.

Web The rule provides a safe harbor for such loans from ATR liability at the end of a 36-month seasoning period if the residential mortgage loan meets specified product. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web HUD has defined qualified mortgage in a manner that aligns HUDs definition to the extent feasible and consistent with HUDs mission with that of the.

Apply Online To Enjoy A Service. Web ii To rebut the presumption of compliance it must be proven that the mortgage exceeded the points and fees limit in paragraph b1 of this section or that despite the mortgage. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Web Resources to help industry participants understand implement and comply with the Ability to RepayQualified Mortgage ATRQM rule. Web The Ability-to-RepayQualified Mortgage Rule ATRQM Rule requires a creditor to make a reasonable good faith determination of a consumers ability to repay a. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Web On April 27 2021 the Bureau issued a final rule extending the mandatory compliance date of the December 2020 final rule that amended the General Q M definition from July 1.

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z General Qm Loan Definition Delay Of Mandatory Compliance Date

Qualified Mortgage Rules Have Begun Montecitoland Com

N16 Forbes Eng All Pages Mar 20 By Forbes Georgia Issuu

Latrobe Valley Express Wednesday 4 January 2023 By Lvexpress Com Issuu

Pdf Early And Late Human Capital Investments Credit Constraints And The Family

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z General Qm Loan Definition Delay Of Mandatory Compliance Date

Credit Faq How The New Qualified Mortgage Rule Could Impact U S Rmbs S P Global Ratings

Oaktree Funding Non Prime Select Guidelines

Cfpb Eases The Requirements For Lenders To Make Qualified Mortgages Under The Ability To Repay Rule Cullen And Dykman Llp

Tm226390d3 425img010 Jpg

Observer Amp Busness 27 Feb 2012 Oman Observer

Document

Regulation Z Ability To Repay Qualified Mortgage Policy And Procedure Update Compliance Resource

Analysis Of Cfpb S New Ability To Repay Rule For Qualified Mortgages

Document

Delegated Underwriting Training Ppt Download

Student Loan Forecasts For England Methodology Explore Education Statistics Gov Uk